Five Tangible Results from the Business Planning Process

1. BUSINESS PLANNING PROCESS

Remember that the process is more important than the documents.

- Research the need, the market and the competition (current & potential)

- Analyze – SWOT analysis (Strength, Weakness, Opportunity, Threat)

- Plan what you will do once you get the desired resources; Once you get them, the clock is ticking.

- Be Prepared to answer questions accurately, concisely, and quickly. Try not to have to answer, ―I never considered that‖ or ―I‘ve never heard of them.‖

2. BUSINESS RESUME

Create a one or two page business resume that summarizes the process. Use this to get a face-to-face meeting with potential investors, strategic partners, and executive team members.

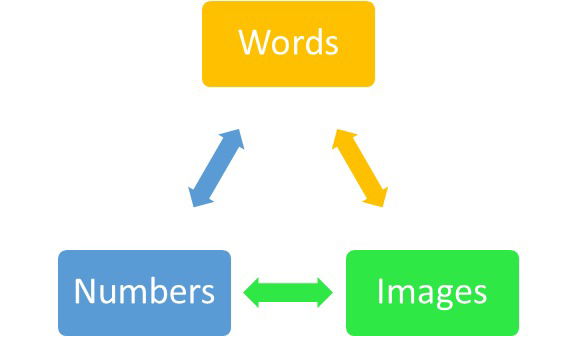

3. BUSINESS PLAN - WORDS

This document should tell the story – As persuasive writing, it should lead the reader along so that they reach the same conclusions you do. Avoid gaps in logic and non-sequiturs. Start out broadly defining the market need, identify and quantify an initial customer base, show how your product or service will meet their needs better than anything else, then detail the operations (marketing, sales, manufacturing, distribution, etc.) and the resources (corporate organization and structure, team, outside resources, timeline, and financial information).

Provide sufficient details in your document(s) to show that you have thought about the plan to the point of being operational. How much office do you need? Are all of the costs included? What is your staffing? Have you included the capital expenditures (such as desks & computers)?

Avoid generalities and vague plans. Would any investor want you to run an ineffective ad campaign? Or have high-cost manufacturing?

Finally, remember that you are telling your story to a specific audience, who may or may not want it in a special format or have specific items they want to be highlighted. For example, if you are preparing a loan document for a bank, cash flow and collateral should be highlighted.

4. FINANCIAL MODEL - NUMBERS

Model your business from Bottom Up assumptions and validate if necessary with some Top Down calculations. You should provide a detailed month-by-month model for either thirty-six or sixty months.

Make sure that the numbers in the model match the numbers in the documents. Include in the body of the document the key assumptions that you have made, along with summary information on the following.

- Profit & Loss (By month for at least 36 months as well as an annual summary)

- Balance Sheet (Annual summary, include historical if appropriate)

- Statement of Cash Flows (Cash used by and provided by both operations and financing)

5. POWER POINT PRESENTATION – SOUNDS AND IMAGES

Some of the people who have control over the resources you need prefer to communicate with sounds and images.

Use a ten to twelve slide PowerPoint presentation, summarizing your customers and their needs, the industry and competitive environment, your business model and your plans for implementation (research & development, marketing, sales, operations, and finance), the key players, a financial summary, and your needs. This is critical to effectively reaching your target audience.